What are the best solar incentives in Texas?

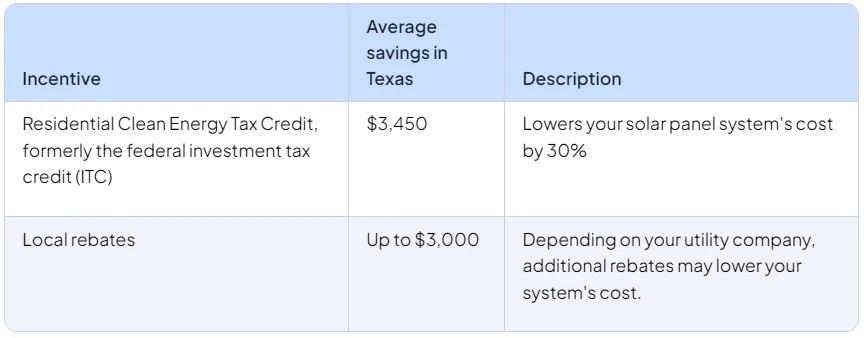

As a Texas homeowner, you have access to some great incentives that can substantially improve your return on investing in solar panels. The two below are some of the most impactful ways to bring down your solar costs.

Residential Clean Energy Credit

The Residential Clean Energy Credit, formerly known as the federal investment tax credit (ITC), can reduce your solar panel system's cost by 30%. Your entire system qualifies for this incentive, including equipment, labor, permitting, and sales tax.

The average cost for a 5 kW solar panel system is around $11,499 in Texas. Once you factor in the 30% credit, the cost comes down to $8,049.

When you file your federal income taxes, you can claim this incentive as a credit towards your federal tax bill. Just keep in mind that to qualify for the ITC, you need to purchase your system either with cash or a solar loan–if you lease your system, you won't be eligible.

You also need a high enough tax bill, though you can roll over any remaining credit year-to-year until the end of 2034 when the ITC expires. The only time you might be eligible for a direct payment for the ITC is if you're a tax-exempt entity, like a nonprofit organization.

Local rebates

Want some money back on your solar panel system? Here are some of the electric companies in Texas that offer rebates when you install solar panels:

American Electric Power SMART Source Solar PV Program:Depending on the size of your solar panel system, you could earn arebate between $1,500-$3,000.

Austin Energy Solar Photovoltaic Rebates & Incentives: You can earn a rebate worth $2,500by installing a solar panel system at least 3 kW in size if you complete Austin Energy's solar education course.

New Braunfels Utilities: Depending on the size and angle of your solar panel system, you can earnup to $3,000as long as your system is at least 3 kW.

Oncor Residential Solar Program: If your solar panel system is between 3-15 KW and installed with a battery, you may be able to receive a rebate. The rebate amount isn't disclosed and depends on many factors, including the solar panels and inverter you choose, the system's location, shade, and more. The program typically runs annually between January and November.

SMTX Solar PV Rebate: You can earn $1/W for installing a solar panel system, up to $2,500. The rebate amount can't exceed 50% of your system's installed cost.

Sunset Valley Rebate Program: If you live in the City of Sunset Valley and qualify for the Austin Energy solar rebate (see above), you can earn an additional $1/W,up to $3,000, as long as your system costs $6,000 or less.

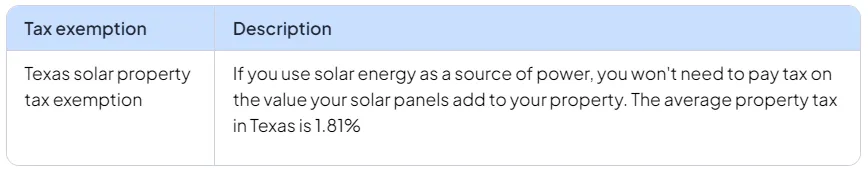

Does Texas offer solar tax exemptions?

In addition to the great rebates and incentives above, Texas also offers a solar property tax exemption. When you install solar panels, it generally increases the value of your home. But thanks to this exemption, you won’t have to pay extra taxes because of that increase.

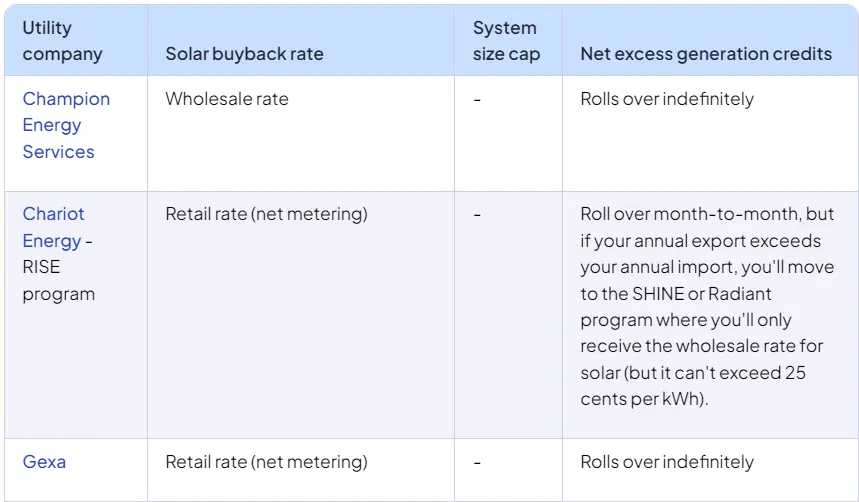

Is net metering available in Texas?

Utility companies in Texas are not legally required to offer solar buyback programs—but many of them do anyway. These arrangements can help you squeeze the most value out of your solar panels by shrinking your utility bills as much as possible.

The best type of buyback program is known asnet metering. Under this system, your utility company works like a bank for solar power—if you can’t use it all at home, you can send it to the grid for an energy credit. When the sun isn't shining and you need to pull electricity from the grid, your utility draws against those credits.

Depending on the weather, the utility’s specific rules, and how much energy you use, net metering makes it so you will often owe very little, or even nothing, on your electric bills with solar panels.

Another type of solar buyback program, net billing, ditches the concept of banked energy credits and instead offers a partial dollar-based bill credit for every kWh you send to the grid.

The details vary quite a lot between utilities and suppliers in Texas. Some utility companies will purchase your electricity at the wholesale rate (what they typically pay for electricity), which is significantly lower than the retail rate (what you pay for electricity). Others will pay a fixed rate. Some utilities also won't let you roll over credits month-to-month or year-to-year. Or, they'll pay you less for any electricity remaining at the end of a billing cycle, called net excess generation.

The good news is that you might be able to shop around for a supplier that offers the best terms to customers with solar power.

Here are some of the solar buyback programs available in Texas for deregulated and regulated utility companies:

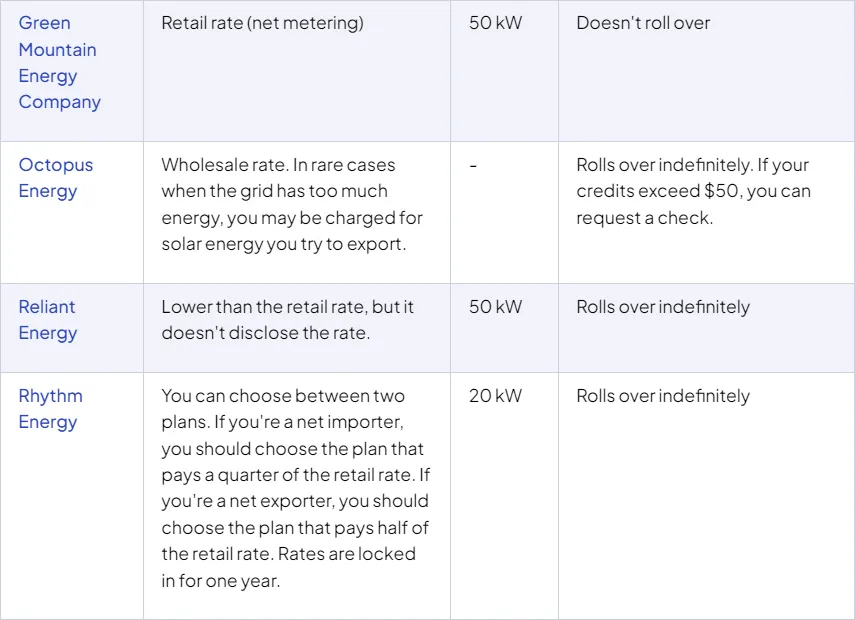

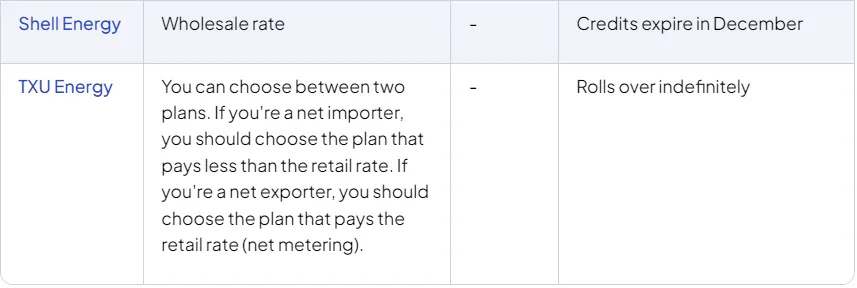

Deregulated utility companies

Depending on where you live, you may be able to choose one of these companies to supply your electricity:

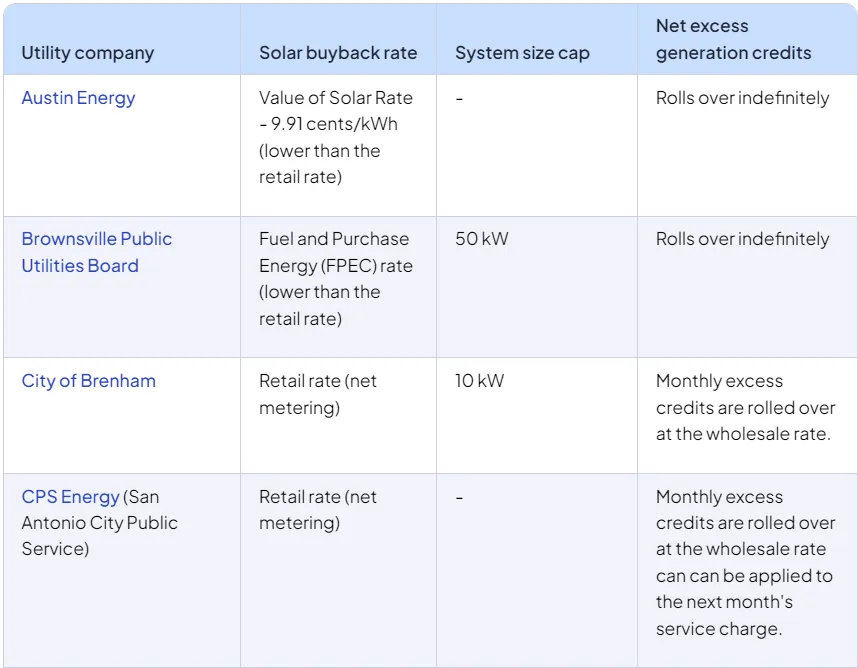

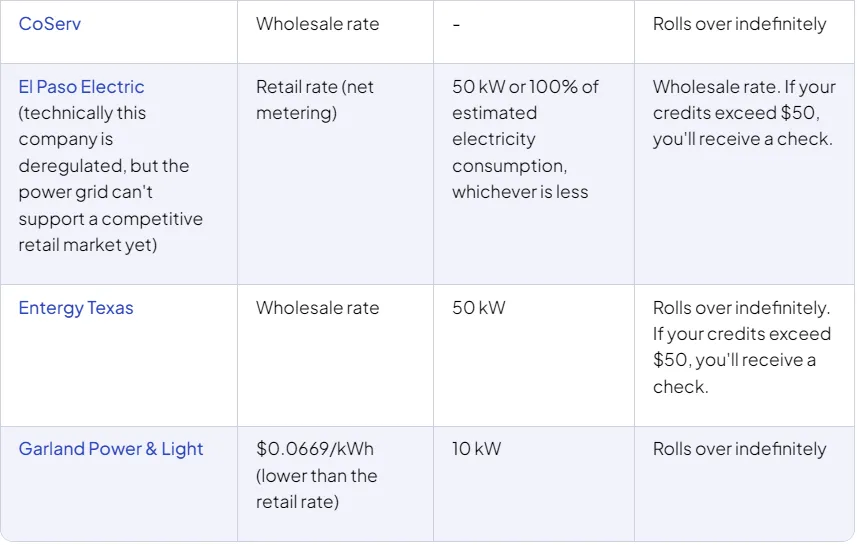

Regulated utility companies

If you live in an area that's chosen to remain regulated, you won't be able to choose your electricity supplier. But, luckily, some regulated electric companies do offer solar buyback programs, including net metering:

Are there energy storage incentives in Texas?

Texas doesn't offer any state-specific battery incentives, though some specific utility companies may offer programs. However, all batteries above 3 kWh in size are eligible for the 30% federal tax credit.

Batteries are great for increasing your energy independence, providing protection from blackouts, and avoiding paying peak pricing for electricity in Texas.

And if your utility company doesn't provide net metering, installing a battery with your solar panel system will also help you save a lot more on your electric bills.